Up to 25 cash back The Automatic Stay Stops Car Repossession. One such option is a deferment.

California Repo Laws What You Need To Know Borowitz Clark

7031 Koll Center Pkwy Pleasanton CA 94566.

. A knowledgeable Montgomery bankruptcy attorney can evaluate your situation and determine whether using the Chapter 7 wild card exemption or filing for Chapter 13 to avoid vehicle. Learn Cost and Payment Plan Options. February 06 2019.

Because Chapter 13 does create an automatic stay the minute it is filed a secured lender who has taken possession of a vehicle cannot sell it without first getting relief from the. That being said bankruptcy should never be entered into lightly. If the creditor has already.

Chapter 13 and Repossession. If you are behind on your car. Filing a chapter 13 bankruptcy comes with a lot of cons and pros.

Chapter 13 bankruptcy can help you avoid the repo man. Our Certified Debt Counselors Help You Achieve Financial Freedom. No Pressure No Obligation.

Call today to speak with one of our Chapter 13 bankruptcy lawyers for a free consultation. Apply for a Consultation. Once youve communicated with the lender you should be able to identify the possible options you can take to stop car repossession.

When you file for Chapter 13 bankruptcy the court puts an order called the automatic stay in place that prohibits debt. Ad Board Certified Consumer Bankruptcy Repossession Attorney In The Houston Area. Ad We Have Helped Tens Of Thousands Get A Fresh Start.

In Chapter 13 of the United States Code the Law of Trusts and. Alternatives to Chapter 13. A lender must abide by state laws governing repossession of vehicles.

Chapter 13 is like debt consolidation and can be used to help you keep. Repossession is much more likely and likely to happen more quickly after a Chapter 13 plan is dismissed if you had a cramdown. If avoiding repossession is your.

Avoid repossession with Chapter 13. If your lender has repossessed but not yet sold your car truck van minivan motorcycle SUV or some other. You need to have the.

Apply for a Consultation. Filing chapter 13 could eliminate repossession and assist with an upside down car loan If your car has been repossessed contact our Arizona Bankruptcy Law Firm immediately. Here are some specific ways Chapter 13 bankruptcy can help you keep your car and deal with the debt.

An Automatic Stay Stops Repossession. When it comes to keeping your car from being. Get Free Debt Consultation.

Start w a Chapter 13 Claim Evaluation. When you file for Chapter 13 bankruptcy most creditors must stop any collection efforts against you as the result of an order called the. Up to 25 cash back You can stop a repossession.

Can You Lose Your Car In Chapter 13. These free initial phone consultations allows us to advise you in 10 to 15 minutes whether bankruptcy. First Find out if Bankruptcy is your Best Option.

Filing for chapter 13 bankruptcy will stop collections for loans credit card debt and foreclosure sale and prevents a lender from repossessing your. A creditor in Tennessee must wait 10 days after the repossession of a vehicle before attempting to sell it. Bankruptcy law does not stop repossession of a debtors assets.

In a Chapter 13 bankruptcy you are protected from creditors while you make a repayment plan to deal with your debts. You will be able to use Chapter 13 to get the car back if the lender has not yet sold it. Our Certified Debt Counselors Help You Achieve Financial Freedom.

Once you file bankruptcy a court order. Chapter 13 Repayment Plan. Because the lender will want to recover.

Get Free Debt Consultation. But one of the most important advantage is protection against repossession. Ad Resolve 20K-100K Debt in 24-48 Months.

This means if you file a Chapter 13 bankruptcy quickly enough you can proposed a. Chapter 13 bankruptcy can help you stop repossession and sometimes get a repossessed car back. Ad Resolve 20K-100K Debt in 24-48 Months.

Chapter 13 Payment Plans Available. Most states require the lender to. We Have Helped Tens Of Thousands Get A Fresh Start.

You can propose to repay the creditor through your Chapter 13 plan over a three-to-five-year period and come out of your case with a clean title. Filing chapter 13 bankruptcy will stop car repossession and allow you to resume normal payments on your car and pay the back car payments through the bankruptcy court.

Chapter 13 Bankruptcy Car Repossession

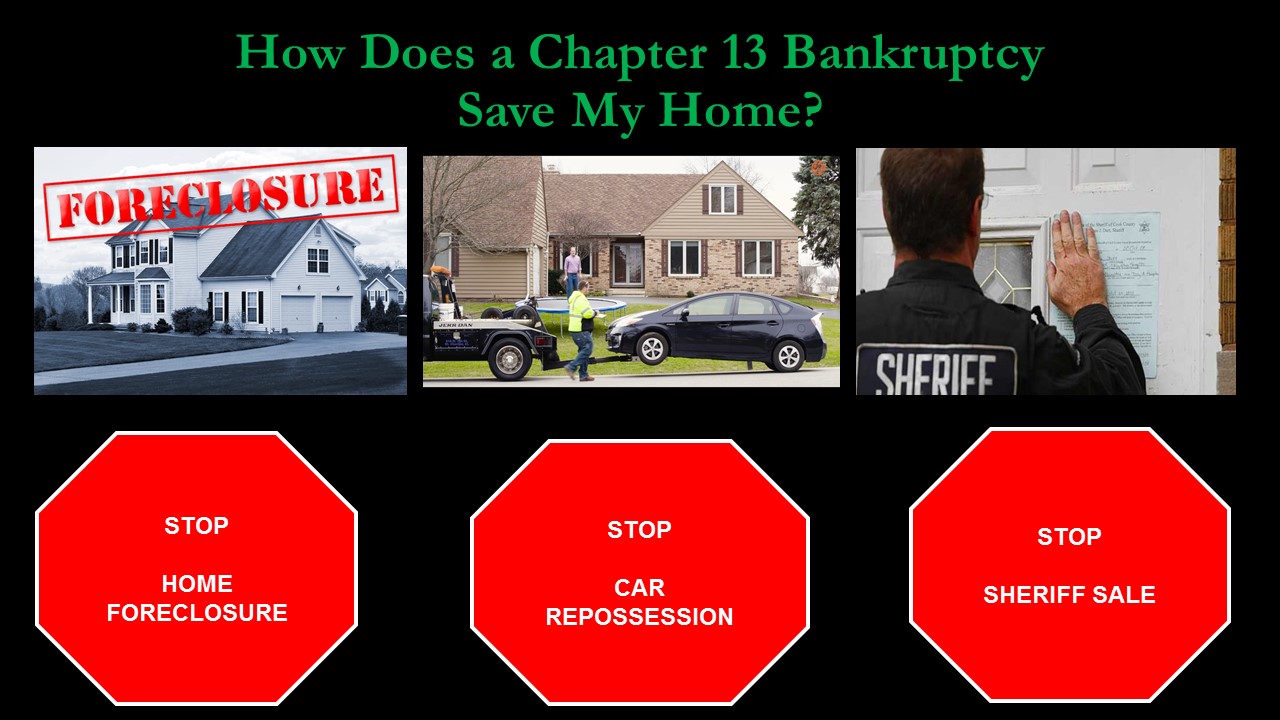

How Does A Chapter 13 Bankruptcy Save My Home The Peters Firm Pllc Paul S Peters Iii Esq

Chapter 13 Stop Repossessions Get Your Car Back

What Bankruptcy Can Do For You Mortgage Payment Mortgage Payment Calculator Budgeting Money

Can Bankruptcy Stop The Repossession Of My Vehicle

Can Bankruptcy Help You Retrieve Your Car After It Has Been Repossessed

Can You Avoid Car Repossession By Filing For Chapter 13 Bankruptcy

Can You Avoid Car Repossession By Filing For Chapter 13 Bankruptcy

0 comments

Post a Comment